Government of Canada Releases Package of Proposed Domestic and International Tax Legislation

The Department of Finance (Finance) released draft tax legislation for public consultation on August 4, 2023, with a stated focus on promoting tax fairness and a clean economy.

The most significant item released is the draft of a major new statute, the Global Minimum Tax Act, spanning almost 150 pages. The statute fulfills Canada’s obligation to implement the OECD’s “Pillar Two” initiative for a 15% global minimum tax on certain large multinationals.

The package also contained new versions of several proposed tax measures released as part of the 2023 federal budget (Budget 2023, originally discussed in our previous bulletin), including those relating to: the general anti-avoidance rule (GAAR), employee ownership trusts, special tax rules on intergenerational business transfers, a 2% tax on public company share buybacks, and carbon capture and other clean technology incentives.

In addition, the package provided updated legislation for two other significant outstanding proposals: the excessive interest and financing expenses limitation (EIFEL) rules that would limit interest deductions and are scheduled to come into effect for most taxpayers in 2024, and the digital services tax which was originally announced in 2020, was then suspended and is now proposed to be enacted with retroactive effect from 2022.

The measures appear intended to provide some tax relief for certain Canadian businesses while following up on governmental commitments to promote fairness in the tax system. A public consultation period will be open until September 29, 2023 for the Pillar Two proposals and until September 8, 2023 for the other proposals.

These new and updated proposals are discussed in greater detail in the sections below.

General Anti-Avoidance Rule

The GAAR in section 245 of the Income Tax Act (Act) denies tax benefits that would otherwise arise from an avoidance transaction that results in a misuse or abuse of the Act. In determining whether an avoidance transaction results in an abuse or misuse of the Act, it is necessary to look beyond the text of the relevant provision(s) and consider their context and purpose to ascertain whether conferring the tax benefit frustrates or offends their underlying rationale.

As part of Budget 2023, the government released proposals to “modernize” the GAAR (the Original GAAR Proposals), discussed in our earlier bulletin, and invited public consultation. The August 4, 2023 package contained a further update of these GAAR proposals (the Revised GAAR Proposals).

The Revised Proposals retain the main features of the Original GAAR Proposals, albeit with certain significant changes. The Revised GAAR Proposals also include references mandatory disclosure rules related to “notifiable transactions” related to “notifiable transactions” enacted after Budget 2023.

The Revised GAAR Proposals make the following main changes from what was originally released in Budget 2023:

- The concept in the Original GAAR Proposals that a lack of economic substance would “tend to indicate” misuse or abuse for the purposes of the GAAR has been eliminated. The Revised GAAR Proposals provide that a lack of economic substance will create a rebuttable presumption of misuse or abuse. Furthermore, the list of factors establishing a lack of economic substance has expanded to include the “use of an accommodation party,” which expression is undefined.

- The Revised GAAR Proposals retain the expanded scope of the term “avoidance transaction”, but subtly change how the purpose component operates. Under the latest proposals, an avoidance transaction will not arise if it is reasonable to consider that obtaining a tax benefit was not one of the main purposes for undertaking the transaction, whereas under the prior proposals an avoidance transaction would exist only if it was reasonable to consider that obtaining a tax benefit was one of the main purposes. It is not clear what effect this change will have. Under current law, the corresponding threshold is that the transaction be “primarily” tax motivated.

- The Original GAAR Proposals allow for optional disclosure of the transactions within 90 days of their completion to avoid any penalties should the GAAR apply. The Revised GAAR Proposals will permit disclosure to be filed up to one year late, though late filing will also extend the statutory limitation period for assessment or reassessment of the GAAR by one year.

- A clause in the new GAAR preamble, stating the GAAR is intended to apply irrespective of whether a “tax strategy is foreseen” has been removed. This provision was originally included to reverse a line of cases that held the GAAR would not apply where Parliament knew about a particular tax strategy and decided not to expand specific anti-avoidance rules to counteract the strategy. This provision was no longer considered necessary in light of the recent Supreme Court decision in Deans Knight, which calls into question this earlier line of jurisprudence.

- The Revised GAAR Proposals would allow gross negligence penalties under subsection 163(2) to be deducted from the penalty imposed under the GAAR.

- An entirely new provision would create a statutory defense to the application of the penalty where the taxpayer demonstrates that it was “reasonable” for the person to conclude that the GAAR would not apply because the transaction was “identical or almost identical” to a transaction or series that was the subject of published administrative guidance or a court decision.

Other features of the original proposals remain unchanged, including that:

- The Revised GAAR Proposals would continue to extend the statutory limitation period for assessment or reassessment by three years where GAAR applies.

- The proposed preamble (intended “to help address interpretive issues and ensure that the GAAR applies as intended”) remains in place, subject to the deletion described above.

- Finally, the Revised GAAR Proposals retain the penalty equal to 25% of the amount of the tax benefit that would have been achieved but for the application of the GAAR (subject to the deduction of any corresponding gross negligence penalty as described above).

The implications of the recent changes to the GAAR proposals are far-reaching. In a forthcoming bulletin, we will present a detailed analysis of the latest GAAR proposals as well as their practical consequences.

Employee Ownership Trusts

Budget 2023 proposed a new succession planning tool for private business owners who choose to sell a controlling interest in their business directly to an “employee ownership trust” (EOT) (or to a Canadian-controlled private corporation (CCPC) wholly owned by an EOT).

Budget 2023 proposed that sellers may benefit from a new 10-year capital gains reserve (generally limited to five years under current rules) where shares are sold to an EOT, and purchasing employees may finance the business acquisition with a loan from the business without certain of the adverse tax consequences that would otherwise apply to loans made to shareholders. For further background, a general summary of the EOT regime proposed by Budget 2023 may be accessed here.

The draft legislative package released by Finance on August 4, 2023 proposes certain changes to the EOT rules largely to correct oversights and technical issues in the original draft, but also provides the following substantive changes:

- In addition to allowing for loans to the EOT as described above, the proposed rules provide that an EOT receiving a low or non-interest bearing loan from a qualifying business generally will not be subject to adverse tax consequences as a result of the low interest rate, provided the loan is repaid within 15 years of the closing date in accordance with the terms of the loan.

- Potential beneficiaries of an EOT are expanded to now include former employees (or their estates), provided that the former employees were employed by the qualifying business while the trust controlled the qualifying business.

- As originally proposed, the EOT rules required that each beneficiary’s interest in the trust be determined in the same manner, based solely on a reasonable application of any combination of hours worked, period employed and total compensation. The new draft legislation provides additional flexibility by allowing the determination mechanism to vary between current and former employees, and between capital and income interests in the EOT.

- In addition to being “reasonable,” the new draft legislation requires each beneficiary’s interest in an EOT to be “equitable.” The accompanying explanatory notes suggest that EOT distributions calculated purely in proportion to employee compensation may not be considered reasonable and equitable in some cases if that would result in “disproportionate” amounts going to highly compensated employees.

- Certain simplifications were made to governance arrangements of EOTs.

- In order to constitute a qualifying business for the purposes of the EOT rules, a target corporation must still be a CCPC, but it is no longer required that all or substantially all of the fair market value of its assets be attributable to assets used in an active business carried on primarily in Canada. Thus, sales of CCPCs that hold foreign subsidiaries with material active business assets should be permissible under the EOT regime.

- Previously, no more than 40% of the directors of a qualifying business must have owned (together with any related or affiliated person or partnership) 50% or more of the fair market value of the shares or indebtedness of the qualifying business. The new draft legislation provides that the 50% test now applies to each class of shares (rather than all shares) of the qualifying business.

The EOT rules are still proposed to come into force on January 1, 2024.

Intergenerational Business Transfers

An exception to a specific anti-avoidance rule — which converts capital gains realized on certain share transfers into a deemed dividend where the transfer is made by a person (other than a corporation) to a non-arm’s length corporation — was enacted in June 2021 pursuant to a private member’s bill in order to facilitate intergenerational business transfers.

Budget 2023 proposed to amend the exception for the stated purpose of addressing perceived deficiencies with the private member’s bill and to strike a better balance between (i) accommodating “genuine” intergenerational transfers of an active business from an individual owner-manager to a family member, and (ii) preserving the application of the specific anti-avoidance rule to other non-arm’s length share transfers. A brief summary of intergenerational business transfer rules proposed by Budget 2023 may be accessed here.

The draft legislation package released by Finance on August 4, 2023 does not propose significant changes to the initial draft legislation released as part of Budget 2023, but does provide some welcome relief and includes new technical and interpretative rules. Changes include the following:

- In order to rely on the exception, Budget 2023 proposed that a child, or group of children, must acquire and maintain control of the target corporation for a period of time, and that steps must be taken to transfer management of the target corporation to the child or children. The new draft legislation provides relief to accommodate transfers of shares amongst children of the individual owner-manager, and to allow management to be assumed by less than all of the children in the relevant group.

- Another condition proposed by Budget 2023 requires that the seller permanently cease managing the business of the target corporation within a specified period of time. The new draft legislation clarifies that management refers to the direction or supervision of business activities, but does not include simply providing advice.

- Budget 2023 proposed that the target corporation’s business must continue to be carried on as an active business for a specified period. The new draft legislation provides an exception to this rule where the business ceases to be carried on as a result of a disposition of all business assets in order to satisfy debts owed to the target corporation’s creditors. In such cases, the time period requirement will be deemed to be met.

- The new draft legislation provides that these intergenerational rules may only be relied upon once by a seller. Successive transfers of shares that derive their value from the same business thus generally could not benefit from the exception.

No change was made to the date on which the proposed rules are expected to come into force. They would apply to transactions occurring on or after January 1, 2024.

Share Buyback Tax

The draft legislative proposals released by Finance on August 4, 2023 include new draft legislation to implement a 2% tax on share buybacks (referred to below as the “Buyback Tax”), updating prior draft legislation that was released as part of Budget 2023 and discussed in a previous bulletin. As discussed in that bulletin, the Buyback Tax would impose a 2% tax on annual net repurchases of equity by publicly traded Canadian resident corporations and certain other public entities (including most REITs, SIFT trusts and SIFT partnerships), subject to limited exceptions. The new proposals do not change the main features of the Buyback Tax, but do correct some specific issues identified in the initial draft.

The changes in the new draft legislation include:

- Expanding the category of “reorganization or acquisition transactions” that are excluded from the Buyback Tax to allow the exchange of equity for equity of a different public entity in some cases. This will accommodate, among other things, certain spin-off transactions and triangular amalgamations. However, it appears a typical “amalgamation squeeze out” transaction would still be subject to the Buyback Tax.

- Broadening the definition of the “substantive debt” that is also excluded from the Buyback Tax. Substantive debt consists of certain “debt-like” preferred equity and was narrowly defined in the original version of the legislation. Substantive debt now includes equity that in accordance with its terms may:

i. be convertible into debt or, if a non-viability contingent capital provision is triggered, any equity (previously it could only be convertible into substantive debt);

ii. pay a variable amount of dividends based on a market interest rate (as opposed to only a fixed rate); and

iii. pay a premium due to an early redemption (instead of the redemption price being capped based on the issue price). - Allowing equity issued upon the exchange of convertible debt, where the debt was originally issued for cash, to be taken into account to reduce the net equity redemptions in a year.

- Excluding employee profit sharing plans and deferred profit sharing plans from an anti-avoidance rule that would treat acquisitions of equity by certain affiliated entities as redemptions.

The Buyback Tax is still proposed to apply starting January 1, 2024.

Clean Technology Incentives

The draft legislative proposals released on August 4, 2023 include details for two of several recently-proposed investment tax credits intended to foster the growth of Canada’s clean technology sector, namely the Clean Technology Investment Tax Credit (Clean Technology ITC) and the Investment Tax Credit for Carbon Capture, Utilization, and Storage (CCUS ITC).

The draft legislative proposals did not provide further details on three other clean technology related credits: the Investment Tax Credit for Clean Hydrogen, the Investment Tax Credit for Clean Electricity and the Investment Tax Credit for Clean Technology Manufacturing. Details for the Investment Tax Credit for Clean Hydrogen and the Investment Tax Credit for Clean Electricity are expected to be released shortly. These five green tax credits would be non-cumulative, meaning taxpayers would only be able to claim one of them for a given property, requiring careful consideration of their terms and conditions.

These tax credits (with the exception of the Investment Tax Credit for Clean Technology Manufacturing) will only be fully available where certain labour requirements are met. The draft legislative proposals provide further details on these labour requirements. Generally speaking, two conditions would have to be met; otherwise the applicable credit rate would be reduced by 10%:

- Each covered worker must be compensated (i) in accordance with an eligible collective agreement, or (ii) at a level at least equivalent to the value of wages and benefits provided to similar workers under such an agreement; and

- At least 10% of the labour performed by workers in the so-called Red Seal trades must be performed by registered apprentices.

These labour requirements do not apply to business visitors to Canada as described in section 187 of the Immigration and Refugee Protection Regulations nor do they apply to administrative, clerical or executive employees.

Clean Technology Investment Tax Credit

The Clean Technology ITC was first announced by the federal government in the 2022 Fall Economic Statement. Later, in Budget 2023, the government signalled its intention to broaden the scope of the credit to include geothermal energy equipment.

The Clean Technology ITC would be equal to 30% of the capital cost of “clean technology property” acquired by the taxpayer on or after March 28, 2023. This credit rate would be reduced by half for property acquired on or after January 1, 2034, and reduced to nil for property acquired after December 31, 2034. To qualify for the credit, the property acquired by the taxpayer would have to:

- be situated in Canada and be intended for use exclusively in Canada;

- not have been used, or acquired for use or lease, before it was acquired by the taxpayer;

- not be leased by the taxpayer to another person unless certain conditions are met; and

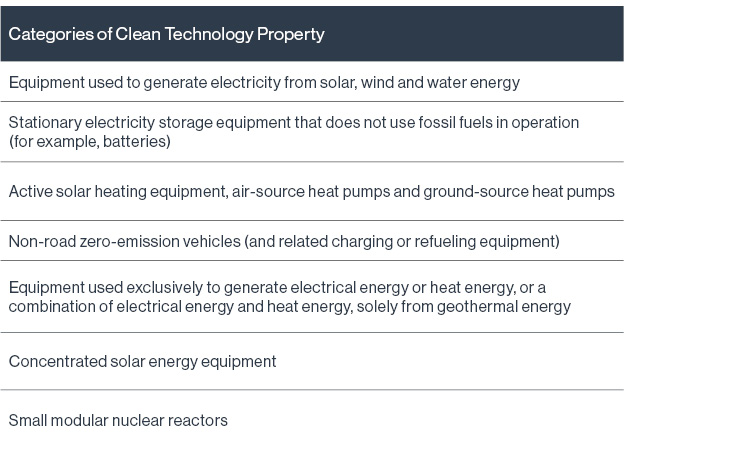

- fall within one of the listed categories of equipment, which can be summarized as follows:

The draft proposals include clarifying amendments confirming that where a partnership acquires qualifying property, each partner will generally be entitled to claim the Clean Technology ITC in respect of its reasonable share of the property.

Investment Tax Credit for Carbon Capture, Utilization and Storage

The CCUS ITC was first announced in the 2021 federal budget. The release of a first set of draft legislative proposals by Finance, which occurred on August 9, 2022, was followed by several rounds of public consultations and the announcement of design changes to the CCUS ITC in Budget 2023. This process has now culminated in the revised draft legislative proposals released on August 4, 2023.

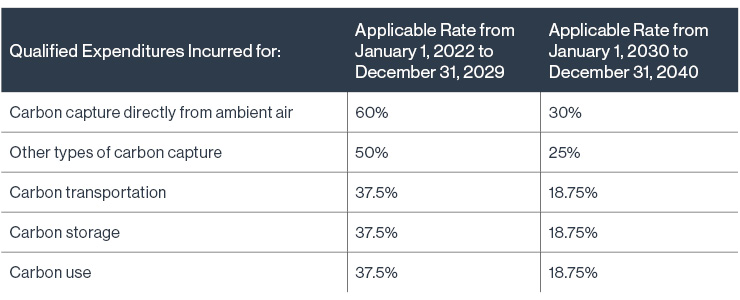

The revised draft legislative proposals for the CCUS ITC are complex and technical. As currently drafted, the CCUS ITC would be refundable and would apply to qualifying expenditures incurred between January 1, 2022 and December 31, 2040. The applicable credit rate will vary according to the type of expenditure involved, and would be reduced by half for expenses incurred after January 1, 2030 as follows:

The CCUS ITC would be calculated on the capital cost of qualified CCUS expenditures, which are grouped into four categories, each subject to specific conditions: carbon capture, storage, transportation and use. For all types of expenditures (except qualified carbon use expenditures), the CCUS ITC would be calculated based on the portion of the expenditure equal to the proportion of all captured carbon that the CCUS project is expected to support for storage or use in one of the following eligible uses:

- storage of captured carbon in dedicated geological storage; or

- producing concrete in Canada or the United States using a qualified concrete storage process.

In addition, to qualify, expenditures would have to be incurred in respect of a qualified CCUS project, which entails further conditions. Qualifying expenditures can occur after the commencement of commercial operations (with the resulting credits being labeled in the rules as “CCUS refurbishment tax credits”), but subject to a limit equal to 10% of total qualified CCUS expenditures incurred before the first day of commercial operations of the CCUS project.

Excessive Interest and Financing Deductibility Rules

The draft legislative proposals released by Finance on August 4, 2023 include revised legislation to implement the EIFEL rules (the Revised Rules). The EIFEL rules are part of a comprehensive international effort to combat base erosion and profit shifting led by the Organisation for Economic Co-operation and Development (OECD).1

The EIFEL rules limit the deduction of “interest and financing expenses” (whether paid to affiliated or unaffiliated parties) of corporations and trusts (that are not “excluded entities”) to a fixed percentage, or “fixed ratio,” of earnings before interest, taxes, depreciation and amortization (EBITDA) for Canadian income tax purposes. Eligible corporate groups may also elect to have a “group ratio” apply as an alternative to the “fixed ratio.”

The entry into force of the EIFEL rules has not changed; the EIFEL rules will limit the deductibility of net interest and financing expenses of corporations and trusts (that are not “excluded entities”) to a fixed percentage of 40% of EBITDA for taxation years that begin on or after October 1, 2023. For taxation years that begin on or after January 1, 2024, the limitation will be equal to a fixed percentage of 30% of EBITDA.2

Notable Changes to the Proposed Legislation

a. New Filing Requirement

The Revised Rules provide that each taxpayer will be required to file, with its income tax return in respect of a taxation year, a prescribed form containing prescribed information with respect to the deductibility of its interest and financing expenses. Failure to file such prescribed form (including failure to provide the information required by the form) will allow the Minister to reassess the taxpayer outside of the normal reassessment period.

b. Broadening Exemptions, Again – Changes to “Excluded Entities”

The EIFEL rules do not apply to “excluded entities.” Excluded entities include members of certain groups that, roughly speaking, do not have any significant foreign activities or ownership connections, and do not pay significant interest to non-arm’s length “tax-indifferent” investors.

The Revised Rules expand this exclusion by limiting the partnership and trusts that are considered “tax-indifferent” to those which are more than 50% owned by tax exempt entities and non-residents (raised from a 10% threshold under the prior proposals).

The Revised Rules, and accompanying technical notes, also provide additional clarity about the types of foreign activities that could prevent the exemption from applying. In particular, merely holding shares or debt of a foreign affiliate will not be considered a foreign activity for this purpose.

c. Expansion of the Public-Private Partnership (PPP) Exemption

The prior version included an exemption for taxpayers that entered into certain PPP agreements with a public authority. In response to criticism that this PPP exemption was too narrow, Finance has expanded the exception for “exempt interest and financing expenses” to:

- allow the taxpayer, or a partnership of which the taxpayer is a member, to enter into the agreement with a public sector authority;

- permit the exemption to apply where any public sector authority owns, leases or has a right to acquire the project property (the prior version required the specific public sector authority contracted with to own such property, and only immovable properties qualified);

- allow a different entity to borrow the funds required under the PPP agreement;

- remove the prohibition on borrowing from lenders that have a direct or indirect equity interest in the taxpayer – under the Revised Rules any arm’s length lenders will be permitted (as well as certain non-arm’s length lenders that are effectively conduits to arm’s length lenders).

Although these are welcome changes to the PPP exemption, the Revised Rules do not include a broad industry-specific, or real estate/infrastructure-specific exception – as provided for in the equivalent U.S. rules limiting interest deductibility. The Revised Rules have also not addressed the degree of connection an expense should have in relation to a project contemplated under a PPP agreement.

d. Group Ratio Election

The EIFEL rules include a group ratio rule to provide qualifying taxpayers with an elective alternative to calculate the amount of their deductible interest and financing expenses. In essence, the group ratio allows a taxpayer to deduct interest and financing expenses in excess of the Fixed Ratio. When calculating the “group ratio,” this new iteration of the draft legislation provides a 10% uplift of the net third-party interest expense to the book EBITDA ratio. This welcome change is meant to account for book-to-tax timing differences given that the group ratio is based on an accounting measure of income and expenses.

For a more detailed review of the Group Ratio, please refer to our two previous publications on the EIFEL rules.3

e. Section 216 Filers

Non-resident taxpayers receiving payments on account of rent on real or immovable property in Canada or a timber royalty can elect to pay tax under Part I of the Income Tax Act, rather than pay tax under Part XIII, thereby paying income tax on net rental income (or net income from a timber royalty). Section 216 is amended such that the calculation of the Part I tax under subsection 216(1) is made without applying the definitions “eligible group entity,” “excluded entity” and “fixed interest commercial trust.” As such, the Revised Rules appear to take a harsh approach with respect to non-resident taxpayers filing returns under subsection 216(1), as these taxpayers cannot be eligible group entities, excluded entities or fixed-interest commercial trusts, resulting in an inability to elect under the Group Ratio, or to transfer or receive capacity from eligible group entities.

The explanatory notes also confirm Finance’s intention for section 216 filers to be considered residents of Canada for the purposes of the EIFEL rules (such as the computation of adjusted taxable income), but cannot carry forward interest and financing expenses incurred in a previous year. It was previously unclear how these rules would be applied to such taxpayers.

Notwithstanding that these non-residents may never be in a position to benefit from a deduction on interest expense denied under the EIFEL rules, as a result of recent amendments to the withholding tax rules, the interest may nonetheless be subject to withholding taxes.

f. Foreign Affiliates

The previous version of the revised EIFEL rules released on November 3, 2022 saw the introduction of amendments aimed at the interaction of the EIFEL rules with the foreign affiliate rules. The latest iteration of the rules further addresses technical points with respect to foreign affiliates.

The EIFEL rules provide an election to, in effect, forgo a foreign accrual property loss (FAPL) in order to avoid having to include expenses that gave rise to the FAPL in a taxpayer’s interest and financing expenses. Because a foreign affiliate’s FAPL can only be applied against its foreign accrual property income (FAPI) and not against the Canadian shareholder’s own income, there are cases where a FAPL may never actually be used to reduce Canadian taxable income. Absent an election as provided for in this legislative package, certain Canadian shareholders could face a scenario where they would never be able to use the FAPL created by a controlled foreign affiliate, but would still be denied interest deductions because of the reduction of interest and financing expenses underlying such FAPL.

To ensure the elected amounts reflect only interest and financing expenses otherwise resulting in a FAPL, the total of the elected amounts in an affiliate taxation year is limited to the lesser of the FAPL and the affiliate’s relevant affiliate interest and financing expenses for the affiliate taxation year.

New rules were also enacted to account for a Canadian shareholder’s different ownership percentages of its controlled foreign affiliates. This change was required to ensure payments between controlled foreign affiliates that result in FAPI/FAPL are properly accounted for.

g. Easing Taxpayer Compliance with the New Pre-Regime Loss Rule

The EIFEL rules provide for “restricted interest and financing expenses,” which can only be carried forward (pursuant to the three-year carry forward of excess capacity), unlike other losses, such as other non-capital losses, which can be carried forward 20 years and carried back three years.

Under the EIFEL rules, a portion of a non-capital loss for another taxation year that is deducted by the taxpayer may be added back for purposes of calculating the taxpayer’s “adjusted taxable income” (ATI) (EBITDA for purposes of the EIFEL rules). The add-back generally applies to the extent that the loss can reasonably be considered to derive from amounts deducted by the taxpayer in the taxpayer’s loss year in respect of its interest and financing expenses.

Compliance proved to be problematic for taxpayers – tracking losses attributable to interest and financing expenses arising in taxation years that ended prior to the introduction of the initial draft legislation is an onerous task. As such, Finance has appropriately provided an election, whereby taxpayers can elect to add back 25% of the amount deducted in respect of non-capital losses in a loss year ending before February 4, 2022, rather than requiring the taxpayer to identify the amount of pre-regime losses attributable to interest and financing expenses.

Where the election is made, the new “specified pre-regime loss” rule assumes that 25% of a taxpayer’s non-capital losses for the earlier years are attributable to interest and financing expenses and can therefore be added-back when calculating its ATI.

Our Insights

- Most of the changes to the latest iteration of the draft EIFEL rules address technical inconsistencies, especially with respect to the interaction between the EIFEL rules and the rest of the Income Tax Act. The announced changes will help ease the introduction of these rules into the Canadian tax landscape for some taxpayers but gaps remain which are unlikely to be addressed prior to the coming into force of the rules on October 1, 2023, so uncertainties remain in how the EIFEL rules will apply in many situations.

- While broadening the scope of taxpayers that will be exempt from the EIFEL rules does provide some relief, we maintain that increasing financing costs in the current global financial climate, combined with restrictions on the deduction of such expenses, could impact inbound investments in Canadian businesses.

- Finance still has not addressed their disproportionate impact on certain capital-intensive industries, such as real estate and infrastructure. Similar to the expansion of the definition of “excluded entities”, the expansion of the PPP exemption addresses the inconsistencies pointed out to Finance and should help in promoting investment in major infrastructure projects where the private and public sectors partner together. However, unlike the U.S. approach to rules limiting the deduction of interest and financing expenses, it does not seem that Canada will adopt similar explicit exceptions for all real estate and infrastructure investment. As such, we may see investors increase investment outside Canada and reduce investment in Canada. In our view, these measures are also inconsistent with the government’s stated policy of increasing core and social infrastructure investments and transitioning to a green economy.

- The approach taken to taxpayers filing under subsection 216(1) seems unnecessarily harsh and consideration should be given to provide some relief to these taxpayers.

Finance has opened a new public consultation period during which submissions may be made with respect to the revised EIFEL rules. The deadline for submissions is September 8, 2023.

Pillar Two and Digital Services Tax

On October 8, 2021, 137 countries (including Canada and the United States) led by the OECD and G20 countries agreed to (i) adopt new rules to impose a special tax on digital services of multinationals with annual revenues of at least €20 billion (Pillar One) and (ii) adopt a global 15% minimum tax for multinationals with annual revenues of at least €750 million (Pillar Two).

Since that agreement, the parties have been preparing a multilateral tax treaty to implement Pillar One and a set of model rules that each participating country would enact in its domestic law to implement Pillar Two. Pillar One would give each country the right to impose tax on relevant multinationals that have at least €1 million of sales in that country – even in the absence of a traditional nexus for cross border taxation, namely “carrying on business” in the source country or a “permanent establishment” in the source country.

Pillar Two would see worldwide book profits taxed at a rate of at least 15%. The initial focus of Pillar Two was to impose a “top-up” tax on Canadian parent corporations to the extent that their subsidiaries are subject to a tax that is less than 15% of their accounting income. Canada’s implementation of Pillar Two goes further by imposing a “qualified domestic minimum top-up tax” on Canadian corporations to the extent the Canadian corporation pays tax on its income of less than 15% of its book income.

The August 4 draft legislative proposals include a draft of a new statute (the Global Minimum Tax Act) to implement, with effect next year, the two elements of Pillar Two explained above. The Global Minimum Tax Act left for future action the highly controversial “Undertaxed Profit Rule,” pursuant to which, for example, Canada would impose a tax on a Canadian subsidiary to the extent that the subsidiary was part of a group with a foreign parent that is resident in a non-Pillar Two jurisdiction. Under this rule, the Canadian subsidiary would be subject to tax by reference to the non-Canadian income of the foreign parent or foreign sister companies because that income had not been subject to at least 15% tax in the foreign jurisdictions.

The government has invited comments on the draft legislation by September 29, 2023. Corresponding amendments to the Income Tax Act are expected shortly.

The August 4 draft legislative package does not implement Pillar One. Instead, it includes the controversial Digital Services Tax Act pursuant to which corporate groups (including Canadian multinationals) with annual revenues of at least €750 million, of which at least C$20 million is derived from Canadian parties, would be subject to an excise tax of 3% of specified gross Canadian digital services and related income (Digital Services Tax). We understand that this tax will not be creditable or deductible by a Canadian or non-Canadian taxpayer in computing its ordinary income tax payable.

The Digital Services Tax is particularly controversial because all participating countries, including Canada, agreed in October 2021 to forego imposing a tax on digital services if Pillar One was implemented by December 31, 2023. When it became apparent in July 2023 that the year-end deadline would not be met, substantially all of the parties to the Pillar One agreement, except Canada, agreed to extend the deadline to the end of 2024.

Canada’s refusal to defer the implementation of the Digital Services Tax has sparked heated exchanges across the Canada-U.S. border (including the threat of a trade war) because U.S. multinationals such as Meta, Amazon and Google are likely to bear substantially all of the burden of the tax. The Digital Services Tax follows other recent controversial legislation that have significantly impacted the businesses of U.S. digital multinationals in Canada, and resulted in Meta not posting any news on their platforms for Canadian users.

The implications of the recent changes to the GAAR proposals are far-reaching and controversial. Moreover, many of the GAAR Proposals addressing the abuse or misuse test should be unnecessary in light of the recent decision of the Supreme Court of Canada in Dean’s Knight. In a forthcoming bulletin, we will present a detailed analysis of the latest GAAR proposals as well as their practical consequences.

2 The EIFEL rules provide for an anti-avoidance rule that would apply to taxpayers that undertake a transaction or a series of transactions to trigger an early taxation year-end for the purpose of deferring the application of the EIFEL rules.

3 Refer to the first footnote.