Jan. 31, 2025 - First published by the Canadian Tax Foundation in (2024) 72:4 Canadian Tax Journal. Treaty Provides Unique Benefits To Canadians Migrating To The United States Canadians who emigrate to the United States or elsewhere face many decisions and considerations...

Increase of Transfer Duties in Montréal

The City of Montréal has adopted a bylaw that will increase the transfer duties payable in Montréal for transactions exceeding $2 million, starting on January 1, 2020.

The City is adding a new bracket for the basis of imposition for transfers of immovables exceeding $2 million and has set the marginal rate to calculate the transfer duties for this bracket at 3.0% (instead of the current 2.5%).

In the province of Québec, the transfer of an immovable, in particular by sale, under a lease with a term of more than 40 years or by emphyteusis will give rise to the assessment of transfer duties.

Each municipality in Québec must collect transfer duties on transfers of immovables located in its territory. These duties, payable by the transferee to the municipality, is due from the date the transfer is registered.

The basis of imposition for the transfer duties is the greatest of the following amounts:

- the amount of the consideration provided for the transfer of the immovable;

- the amount of the consideration stipulated in the deed of transfer of the immovable;

- the amount of the market value of the immovable at the time of its transfer.

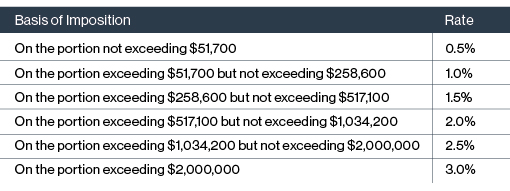

Starting on January 1, 2020, the transfer duties on the transfer of immovables located in the territory of the City of Montréal will be calculated as follows:

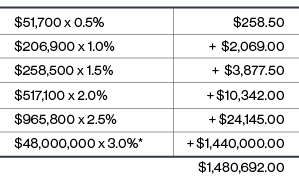

For example, starting on January 1, 2020, the “welcome tax” resulting from the transfer of an immovable located in the City of Montréal with a basis of imposition of $50 million would be calculated as follows:

* Instead of $1.2 million prior to January 1, 2020 (at a rate of 2.5%).

We therefore encourage you to consider your transactions planned for the coming weeks in light of this new bracket for the basis of imposition.

Key Contacts

Expertise

Related

Federal Court of Appeal Confirms CRA Can Collect Arrears Interest Despite Absence of a Tax Debt

Dec. 04, 2024 - The Federal Court of Appeal (FCA) recently dismissed the Bank of Nova Scotia’s (BNS) appeal and upheld the Canada Revenue Agency’s (CRA) practice of charging arrears interest on a non-existent tax debt where audit adjustments increase taxable income that is offset by the carryback of a loss...